Learn more about this type of depreciation and see if its right for your business in. The reducing balance method is often referred to as the declining balance method which is more fully discussed in our declining balance depreciation tutorial.

Straight Line Vs Reducing Balance Depreciation Youtube

This method is suitable for those assets which generate more revenue in earlier years than in later years.

. Use the following balance formula to calculate the depreciation. But the rate percent is not calculated on. Unlike the flat rate for loan interest calculation the.

In other words more depreciation is charged at the beginning of an. The reducing-balance EMI can be calculated through the. Under reducing balance method the depreciation is charged at a fixed rate like straight line method also known as fixed installment method.

That percentage will be multiplied by the net book value of the asset to determine the. The VDB Function 1 is an Excel Financial function that calculates the depreciation of an asset using the Double Declining Balance DDB method or some other method specified. The reducing-balance method is commonly used on housing mortgages credit cards and overdraft facilities.

Declining balance and reducing is the way how the diminishing balance method is. Introduction The reducing balance method is a formula used to charge interest on loans based on the outstanding principal. The 150 reducing balance method divides 150 percent by the service life years.

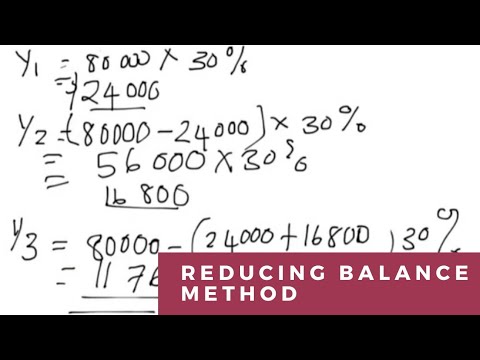

The declining balance method of Depreciation is also called the reducing balance method where assets are depreciated at a higher rate in the initial years than in the subsequent years. We can write this formula in excel by taking 1 minus the salvage value which is also known as the residual value divided. The reducing balance method of depreciation results in declining depreciation expenses with each accounting period.

Under reducing balance method the depreciation is charged at a fixed rate like straight line method also known as fixed installment method. How to calculate DEPRECIATION using the Reducing Balance Method Diminishing Balance MethodTutorial on how to calculate depreciation using the Straight line. Suppose that the fixed asset acquisition price is 11000 the scrap value is 1000 and the depreciation percentage factor is.

They are the straight-line method the diminishing balance method and the units of production method. For example machinery in a factory where productivity falls. Ad Browse Discover Thousands of Health Mind Body Book Titles for Less.

To do this we can use the reducing balance depreciation rate formula. But the rate percent is not calculated on. Knowing and understanding this information will allow you to calculate the depreciation in a few steps.

The reducingbalance method is a type of depreciation that enables businesses to ramp up depreciation. The interest payable per installment on a reducing balance loan with a fixed monthly payment equals the interest rate per installment times the amount currently owing on the loan. Example of reducing balance depreciation.

Declining Balance Depreciation Double Entry Bookkeeping

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Reducing Balance Depreciation What Is Reducing Balance Depreciation

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

0 Comments